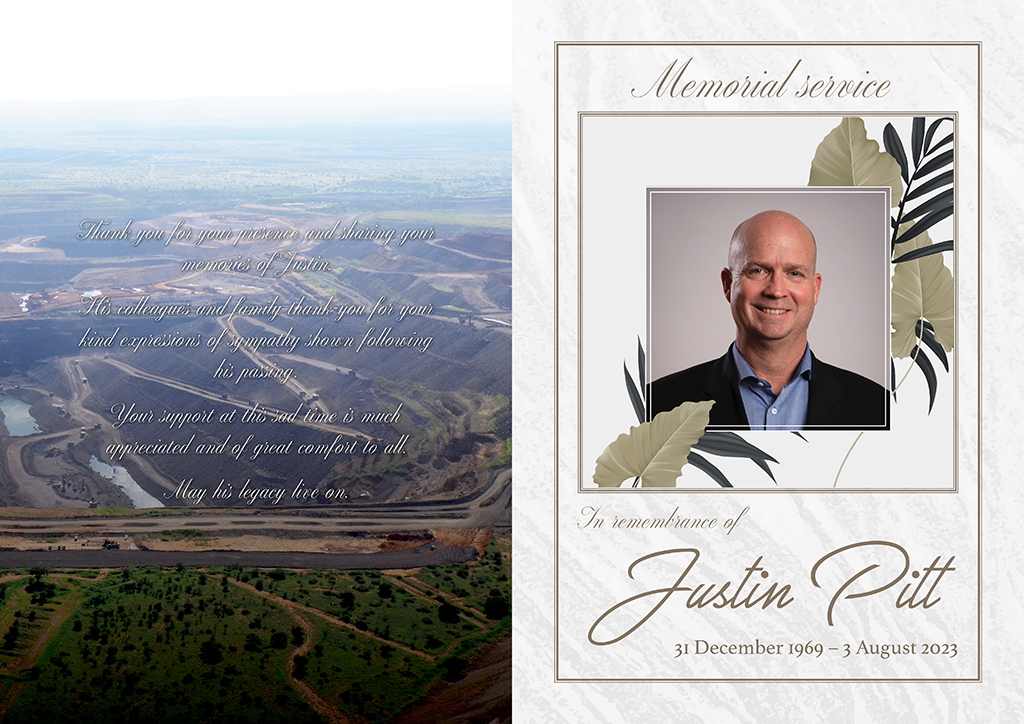

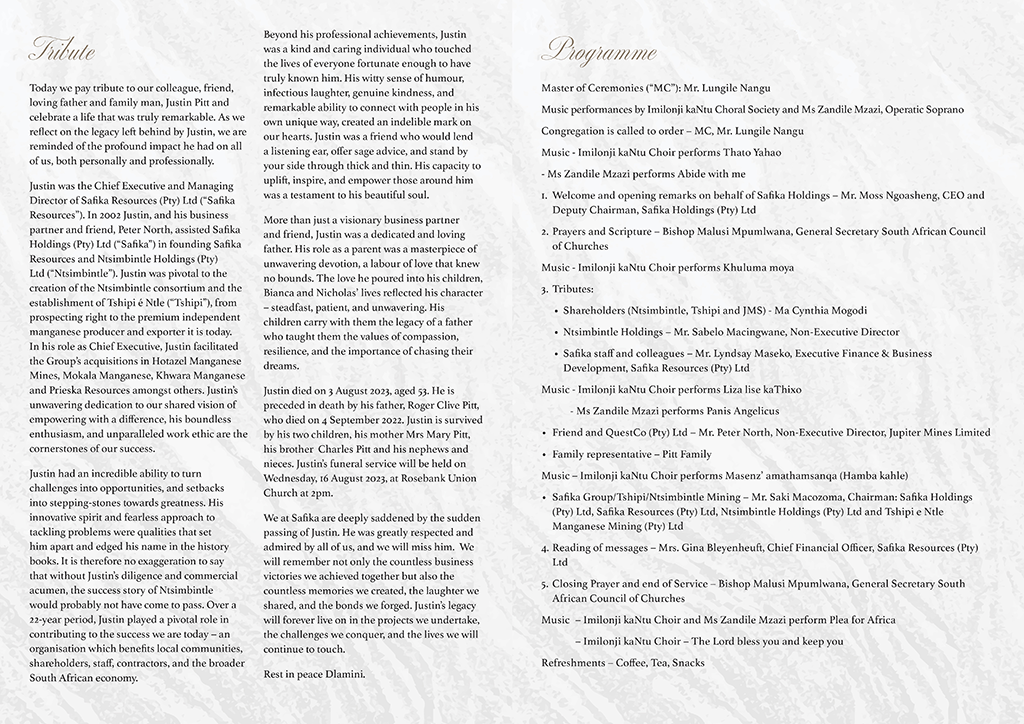

Justin Pitt Dies, Safika Loses One Of Its Own.

STATEMENT FROM CHAIRMAN SAKI MACOZOMA

It is with a heavy heart that I announce that Justin Pitt, managing director of Safika Resources, has passed away. Justin had not been well since June 2023. We hoped he would recover and continue to lead the Safika Resources team in the management of our assets, but it was not to be. May his soul rest in peace.

Over a 22-year period, Justin played a pivotal role in building Safika Resources to its current level of success – benefiting local communities, shareholders, staff, contractors, and the broader South African economy.

Since the first consignment of ore went to market in 2012, Tshipi manganese mine in South Africa’s Kalahari basin has paid dividends of R9,2-billion. It is no exaggeration to say that without Justin’s diligence and commercial sense, Tshipi may never have been built. It is a testament to the esteem in which Justin was held that he was honoured by being granted a clan name, that of Dlamini. In South Africa, clans are groups of families with different surnames but sharing one clan name. That is a measure of how respected Justin had become.

His legacy will be the jobs he helped provide, the communities he helped benefit, the wealth provided to the South African economy and the team he led which will continue his work to ensure even greater achievements in the years to come.

I pass our condolences to Mrs. Mary Pitt, Justin’s children, Bianca and Nicholas, and his extended family. Please put the entire Pitt family in your prayers.–

Safika chair appointed non-executive director of global packaging and paper group Mondi

Safika chairman, Saki Macozoma, has been appointed a non-executive director of the Mondi Group with effect from May 2022. He will join the multinational packaging and paper group’s audit and nominations committees.

According to Philip Yea, chairman of the board of Mondi, Macozoma’s appointment to the board is in line with efforts to broaden the board’s diversity and bring in new managerial perspectives.

Mondi is a global leader in packaging and paper, employing around 26,500 people at over 100 production sites across more than 30 countries, with key operations located in Europe, North America and Africa. Its business includes managing forests and producing pulp, paper and films, to developing and manufacturing industrial and consumer packaging solutions. In 2021, Mondi had revenues of R127-billion and earnings before interest, taxes, depreciation, and amortization of R24.8 billion. It’s premium listing is on the London Stock Exchange.

Announcing the appointment Philip Yea, Mondi’s chairman, expressed delight at Saki joining the board saying: “He has a strong track record as a chair and non-executive director across a number of listed and private entities and brings significant experience from a range of industries. Saki also brings extensive insight into the African business environment.”

Macozoma’s Ntsimbintle has vehicle for manganese consolidation following Gilbertson ouster

THE ousting in mid-October of Brian Gilbertson from Australia’s Jupiter Mines will have important consequences for South Africa’s manganese industry as it hands management control to the ambitious Ntsimbintle Holdings, the company largest shareholder.

Ntsimbintle Holdings is 74% controlled by Safika Resources, a branch of Saki Macozoma’s industrial empire. Macozoma has tended to operate away from the limelight, but in 2019 he nearly listed Ntsimbintle Mining, only to pull the proposal at the last minute.

Market reasons, partly related to China volatility, were cited for the withdrawal of the listing. It’s a pity it didn’t proceed considering the rollercoaster ride manganese prices have been on. Currently, the metal is much in demand both as a hardening agent for steel, but also for its potential use in electric vehicle battery production.

Ntsimbintle Mining owns 51.1% of Tship Borwa, a highly profitable mine in South Africa’s Northern Cape province. The other 49.9% of Tshipi is owned by Jupiter Mines, which makes the ousting Gilbertson all the more interesting.

One line of speculation is that with Gilbertson and Jupiter’s CEO and Gilbertson long-time partner Priyank Thapliyal out of the company, Ntsimbintle has the listed vehicle it desires, and more to boot.

Jupiter Mines is developing a portfolio of mines in Australia’s Yilgarn Valley. Ntsimbintle also has OM Holdings, a Singapore-based business with a smelter complex Sarawak in Malaysia, as a shareholder. Back in South Africa, Ntsimbintle recently opened the Mokala mine with Glencore as a minority shareholder.

The sum of these business interests is that Jupiter is a company with influence and geographic reach with access to an operating base in South Africa where most of the world’s manganese is found. As such it’s a powerful force for consolidation which was one of the reasons Macozoma wanted a listing.

“We are listing for the currency, not the cash,” said Mazocoma in an interview with Miningmx in 2019 before the company decided not to proceed with the IPO. “The currency is for the purpose of consolidation. If we are going to do consolidation in the Kalahari manganese fields, the best way to do that is with paper which is listed. It provides a price, even if you like it or not,” he said.

Under Gilbertson and Thapliyal, Jupiter was a passive vehicle, said one of its major shareholders, AMCI – the US-based minerals investor and trading house during the general meeting that ousted Gilbertson. Focused on paying out dividends, the company didn’t give enough attention to the growth and expansion possibilities before it, AMCI said.

“The CEO has not taken proactive steps to address the diminishing value of the company … and has failed to pursue … any material shareholder value-creating opportunities,” said AMCI director, and Jupiter Mines board member Hans-Jürgen Mende.

Replied Gilbertson: “Those [remuneration] arrangements were set out and entrenched from the outset. I really have not felt that they needed to be changed.” As an explanation, it seemed insufficient, especially as 95% of Jupiter Mines shareholders had voted against the remuneration report in 2021 and 93.4% voted against the 2020 report.

Board statements aside, when the task of voting for the re-election of Gilbertson to the board came up at the general meeting, the conclusion was inevitable. About 78% of shareholders voted against it as well as for the removal of Thapliyal which was another of the resolutions.

It was a sad way for Gilbertson to bow out of public service though it will do nothing to diminish his stature in South Africa mining.

As Gencor boss, he oversaw the creation of the modern Gold Fields, the development of Impala Platinum and the international listing of Billiton, the forerunner to BHP Billition (now BHP), the world’s largest miner.

Written by: David McKay | Originally posted on miningm

New Mokala manganese mine heading for steady state, solar power

JOHANNESBURG (miningweekly.com) – With mining now ramping up, the new Mokala manganese mine in the Northern Cape anticipates being at steady state production by the third quarter of 2021.

Once that happens, the mine expects to be producing more than one-million tonnes of manganese ore a year, with an opencast life-of-mine of more than ten years. Beyond its opencast activities, additional resources are available underground.

Importantly, the mine intends to establish a solar-powered, renewable energy supply in the near term that will decrease its carbon footprint.

The mine is 51% owned by Ntsimbintle Holdings Pty, a broad-based black economic empowerment company led by businessman Saki Macozoma, and 49% by Glencore plc, through its wholly-owned subsidiaries. While Ntsimbintle contributed the exploration and mining rights, Glencore is the project’s technical partner.

Mokala is the second mining project that Ntsimbintle has brought into production in the last ten years, after Tshipi é Ntle Manganese Mine, also located in the Northern Cape.

Site establishment began at Mokala in May 2020, amid the onset of the Covid-19 pandemic. Excavation and construction activities at the mine quickly gained momentum while stringent Covid prevention methods ensured high safety standards,

Manganese ore was accessed just five months after blasting operations began and ore was extracted for the first time on March 19.

An official launch marking this milestone was held on March 29, and the mine’s first shipment of ore took place in May.

Situated about 4 km northwest of the aptly named Hotazel, Mokala is accessed by a main road, the R380, which connects the town of Kuruman to Blackrock and beyond.

KEY HIGHLIGHTS

To develop the mineral resources held on the Mokala property, infrastructural and environmental challenges in recent months needed to be addressed.

The first was the rerouting of the R380 tar road, which originally ran through Mokala’s property. The second, was the redirecting of the Gamagara river, which also runs through Mokala. Rerouting the river was both important and complex.

“The river was a major concern and receiving permission from the relevant authorities that we could redirect it was an important achievement that has extended the life-of-mine,” Mokala CEO Vhonani Mufamadi stated in a release to Mining Weekly. Both of these tasks were undertaken in full compliance with relevant rules and regulations and are now close to completion, the release stated.

Mufamadi described the shareholding structure as being “truly one of the best”. Evidence of this, he said, lay in the efficiency with which Mokala had been brought into production, as well as its success so far and promise of ongoing success.

“The relationship between the two shareholders has been extremely well managed, including the conversion of exploration rights into mining rights,” said Mufamadi.

Glencore, as one of the world’s largest globally-diversified natural resource companies, is a major producer and marketer of more than 90 commodities. Ntsimbintle, which has become a force in manganese mining, is 100% black owned and managed, and comprises entrepreneurial businesses and community broad-based organisations.

“The joint venture between Ntsimbintle and Glencore will provide additional exposure to international manganese markets and increase exports. This, of course, has benefits for the South African economy at large,” Mufamadi added.

EMPLOYMENT AND PROCUREMENT

The policy of the operation is to employ and procure as much as possible locally. Of the mine’s 357 employees and contractors, the majority are sourced from immediate communities.

The vision is to create a culture where employees feel a sense of belonging: “We want our employees to know that their inputs are valued and that they are appreciated as individuals,” said Mufamadi.

Mokala’s long-term vision is to be among South Africa’s safest and cheapest manganese producers. “At peak, we are going to be a significant player in the Kalahari basin and in the manganese supply market,” Mufamadi forecast.

Mokala GM Basie van Wyk highlighted the mine’s safety record. “In spite of considerable construction and mining work being undertaken simultaneously, we have achieved very high safety achievements across the project to date. It goes without saying that we will uphold this high standard as mining progresses,” said Van Wyk.

To identify providers of goods and services that it can use, Mokala works closely with its communities and within Ntsimbintle’s shareholder base. “We have a real passion for the people – both employees and community members – who are involved in what we’re doing. We embraced the Mining Charter from the beginning, and are determined to exceed the targets set for us wherever we can,” Van Wyk added

Opportunities are being continuously sought that may be leveraged with neighbouring operations. “Identifying synergies and expansion opportunities with our neighbours, where value is available for both parties, is an important part of our approach. This, we intend to do while continuing to invest in and develop our employees and communities,” Van Wyk emphasised.

Moss appointed chair of Investec Property Fund

Investec Property Fund Limited

Safika chief executive Moss Ngoasheng has been appointed as the independent non-executive board chair of the Investec Property Fund with effect from September 6, 2021.

Investec Property Fund Limited is a South African Real Estate Investment Trust that listed on the Johannesburg Stock Exchange (JSE) in 2011. The fund pursues a bi-regional investment strategy, focused on building scale and relevance in its core geographies of South Africa and Western Europe.

Moss has been on the board since 2011 and was lead independent non-executive director since 2016.

In a statement, Investec said Moss is highly qualified to lead the fund forward in an increasingly complex environment.

Moss will continue in his existing roles as chief executive and deputy chairman of Safika Holdings.

Safika chairman appointed top advisor to Eastern Cape government

The premier of South Africa’s Eastern Cape province, Oscar Mabuyane, has announced that Safika Holdings chairman, Saki Macozoma has been appointed to a key advisory position in his administration. Macozoma will form part of the premier’s advisory panel on a part-time basis.

The Eastern Cape is South Africa’s second-largest province but also the poorest, in spite of having huge potential in terms of agriculture, tourism, sea cargo and industry.

Macozoma and his fellow appointees Professor Wiseman Nkuhlu and Nomso Kana will advise on strategic planning and ensure government work is properly structured.

Nkuhlu is the Chancellor of the University of Pretoria, Chairman of Rothschild (SA) and a director of companies. Kana works as an entrepreneur in the broadband infrastructure sector. She is a lobbyist for sustainable resource use, and led the South African delegation to the World Sustainability Energy Forum.

Ntsimbintle Holdings R1.3-billion vote of confidence in Tshipi and South Africa’s manganese sector

Johannesburg (19 April 2021) – Ntsimbintle Holdings, has acquired a further 13.8% stake in Jupiter Mines (270.5 million shares), making it the Australian-listed miner’s largest shareholder, with a total holding of 19.9%. Ntsimbintle Holdings invested around

R1.3-billion over the last 18 months in acquiring this stake.

Ntsimbintle Holdings is one of South Africa’s most successful empowered mining companies. In addition to the 39.66% interest held by Safika Resources, a subsidiary of Safika Holdings, its other shareholders include 13 community, women and entrepreneurial entities based mostly in the Northern Cape, of which the John Taolo Gaetsewe Development Trust with its 14.47% interest, is the company’s second largest shareholder.

Ntsimbintle Holdings has a 74% stake in Ntsimbintle Mining, which in turn has been the developer of and leading shareholder (50.1%) in Tshipi é Ntle (Tshipi), South Africa’s largest manganese producer. Ntsimbintle Mining’s partner in Tshipi is Jupiter Mine’s Jupiter Kalahari, which holds 49.9%.

Tshipi is an independently operated-and-managed, blackempowered manganese mining company that operates the Tshipi Borwa Manganese Mine, an open pit operation located in the Kalahari Manganese Field, the largest known manganese bearing geological formation in the world. Tshipi is the largest single manganese mine and exporter from South Africa and one of the five largest manganese ore exporters globally.

Manganese ore is a vital and irreplaceable element in carbon steel production. As manganese is part of a long value chain, demand for manganese ore is ultimately driven by changes in demand from end users, primarily steel producers. Outside of its steel applications, manganese is quietly becoming a significant contributor to the electric vehicle market.

Industry body the World Steel Association forecasts short term steel demand (2021-2022) to grow by 5.8% and with long term growth forecasts (2020-2025) estimated at ~2% per annum, the market fundamentals supporting the acquisition remain competitive.

Despite sporadic small localised waves of COVID-19, Chinese economic activity has not been as gravely affected by the pandemic and with other advanced economies such as the US, implementing various infrastructure backed stimuli packages to boost and support job creation, the manganese ore demand outlook is expected to remain healthy largely due to rebounds in major steel using sectors such as the construction and automotive sectors.

Ntsimbintle’s other assets includes a 9% percent shareholding in Hotazel Manganese Mines, Mokala Manganese, Khwara Manganese and Ntsimbintle Marketing and Trading. These assets enable full integration into the manganese value chain.

Ntsimbintle is a distinguished and successful, empowered mining investment company. Formed in 2003 to pursue exploration and mining opportunities emerging in the South African manganese sector, Ntsimbintle Holdings is a true B-BEE entity as envisaged in the spirit and intent of South Africa’s Minerals and Petroleum Development Act.

Prospecting rights for an area between Kathu and Hotazel, in the Northern Cape were granted in 2006 to Ntsimbintle, which then commenced prospecting activities. To fund mine development and construction, other investors, most notably Pallinghurst Co-Investors/Jupiter Mines and Australian listed OM Holdings acquired stakes directly in Tshipi and in Ntsimbintle Mining respectively. The Tshipi mining right application was approved in 2010 and, after a 20-month construction and commissioning phase, Tshipi Borwa Mine railed and exported its first manganese ore.

Ntsimbintle Holdings chairman Saki Macozoma says: “With this transaction Ntsimbintle, a truly broad-based South African BEE company, has become one of the world’s major forces in manganese mining. This is something that every South African can be proud of particularly because from inception, Ntsimbintle committed to social investment in the Northern Cape and to sharing the economic benefits of mining with local communities. Dividends paid back to shareholders to date has been R3.26 billion.”

“Our R1.3-billion investment in Jupiter Mines brings home some of the interest that was released when we were raising capital for the development of Tshipi. This investment is a significant vote of confidence by Ntsimbintle in the Tshipi mine, and in the future of South Africa’s manganese sector.”

Tshipi’s assets and track record remain enviable: It is a significant, low-cost producer of high-quality manganese ore; it generates strong cash flows and community dividend distribution; it has fully invested, proven mine and logistics infrastructure; and a highly experienced management team.

Saki Macazoma concludes: “Our increasing influence in the manganese sector, will mean that Ntsimbintle can continue to capitalise on regional and co-development consolidation opportunities, and will do so through disciplined value-accretive industry acquisitions, that will allow greater exposure to extremely attractive manganese fundamentals.”

Safika helps to preserve the past and educate for the future

Safika Holdings has restored a historic building at St Andrew’s College in South Africa’s Eastern Cape creating a debating chamber and exhibition center for students at the school. Photographs and memorabilia will be exhibited there. Safika has also provided generous sponsorship for an educational programme

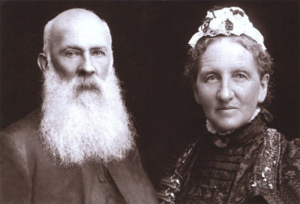

Canon and Mrs. Robert Mullins

St. Andrew’s College was founded in 1855 at a time when black and white communities first encountered each other in the Eastern Cape, often in violent circumstances. Church leaders played a moderating role, especially by establishing schools throughout the Eastern Cape, many of which were formative in the development of future leaders of our country.

Most of these schools were racially segregated. The Anglican Institution, which was founded as a branch of St Andrew’s College in 1860, was a rare exception where young men of faith, black and white, were educated together. At the height of colonial rule, black and white clergymen were prepared for holy orders by Canon John Espin (the Headmaster of St Andrew’s College) and Canon Robert Mullins (the Headmaster of the Anglican Institution). The Anglican Institution then became an autonomous school from 1867 until it closed in 1907 when Canon Mullins retired.

The Anglican Institution trained a large number of clergy, teachers and civil servants, many of whom were leaders and activists in early political movements in South Africa.

Situated in the beautiful grounds behind Graham House is the stone building that was once part of the Anglican Institution.

Safika has a proud history of social responsibility, supporting a wide range of educational and child-orientated initiatives, ranging from financing educational institutions, providing bursaries for high school and tertiary education and thereafter mentoring students in the business world. This latest project is an educational programme which will bring understanding to the College boys of the importance of the Anglican Institution within the educational framework at the time and the role that many of the scholars played in the history of our country.

SAC Donor Report for 2019

2019 Fundraising highlights

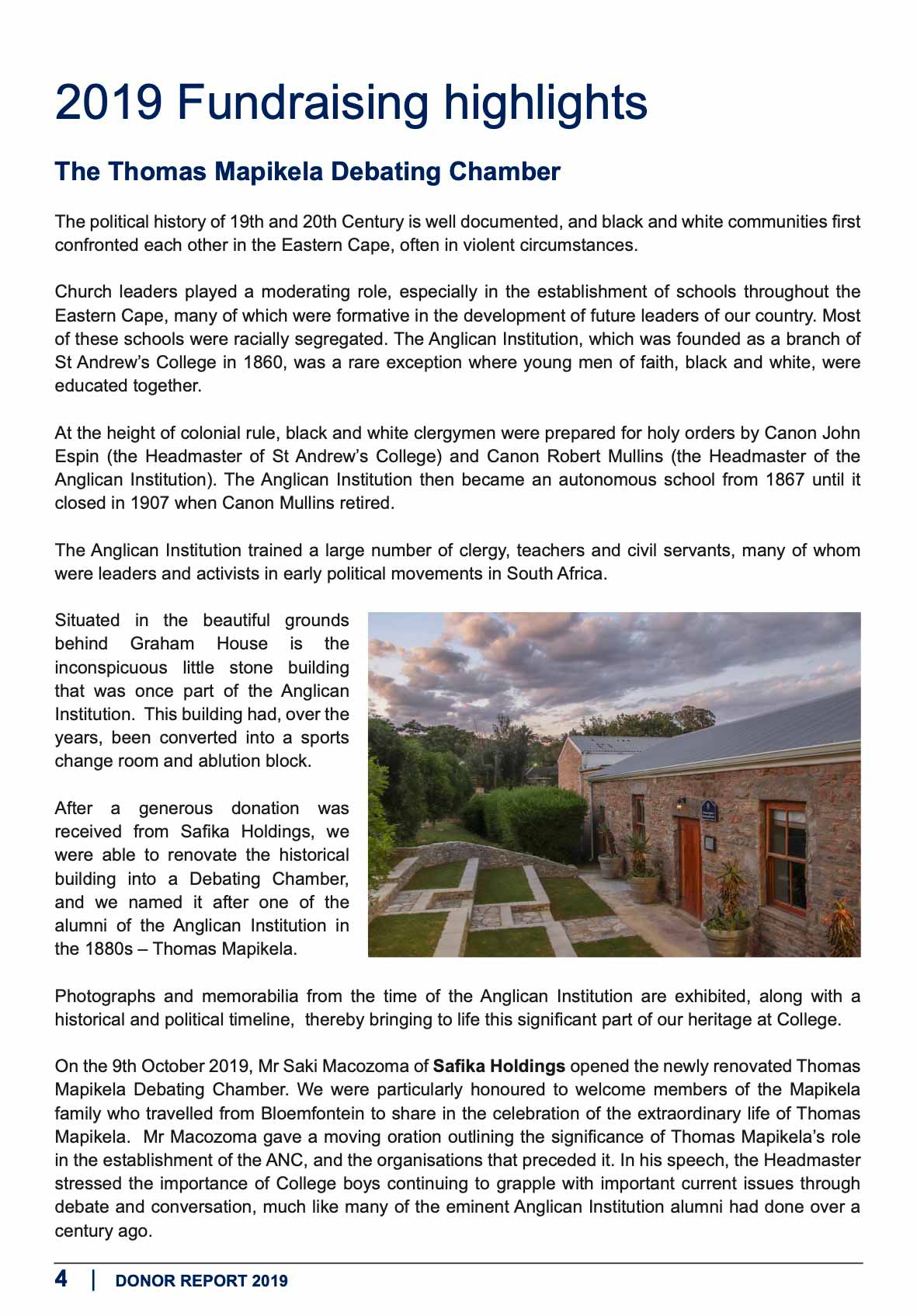

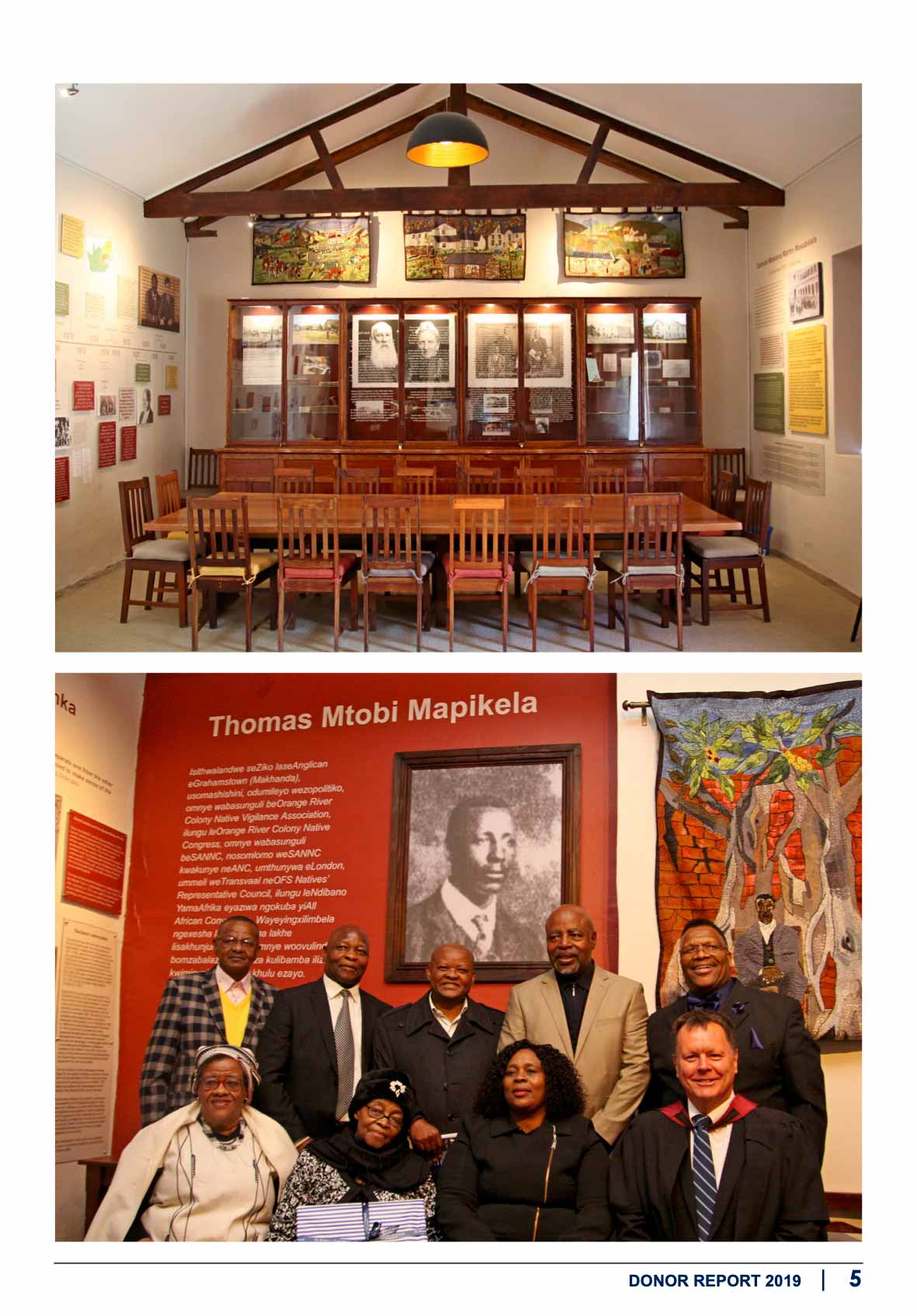

The Thomas Mapikela Debating Chamber

The political history of 19th and 20th Century is well documented, and black and white communities first confronted each other in the Eastern Cape, often in violent circumstances.

Church leaders played a moderating role, especially in the establishment of schools throughout the Eastern Cape, many of which were formative in the development of future leaders of our country. Most of these schools were racially segregated. The Anglican Institution, which was founded as a branch of St Andrew’s College in 1860, was a rare exception where young men of faith, black and white, were educated together.

At the height of colonial rule, black and white clergymen were prepared for holy orders by Canon John Espin (the Headmaster of St Andrew’s College) and Canon Robert Mullins (the Headmaster of the Anglican Institution). The Anglican Institution then became an autonomous school from 1867 until it closed in 1907 when Canon Mullins retired.

The Anglican Institution trained a large number of clergy, teachers and civil servants, many of whom were leaders and activists in early political movements in South Africa.

Situated in the beautiful grounds behind Graham House is the inconspicuous little stone building that was once part of the Anglican Institution. This building had, over the years, been converted into a sports change room and ablution block.

After a generous donation was received from Safika Holdings, we were able to renovate the historical building into a Debating Chamber, and we named it after one of the alumni of the Anglican Institution in the 1880s – Thomas Mapikela.

Photographs and memorabilia from the time of the Anglican Institution are exhibited, along with a historical and political timeline, thereby bringing to life this significant part of our heritage at College.

On the 9th October 2019, Mr Saki Macozoma of Safika Holdings opened the newly renovated Thomas Mapikela Debating Chamber. We were particularly honoured to welcome members of the Mapikela family who travelled from Bloemfontein to share in the celebration of the extraordinary life of Thomas Mapikela. Mr Macozoma gave a moving oration outlining the significance of Thomas Mapikela’s role in the establishment of the ANC, and the organisations that preceded it. In his speech, the Headmaster stressed the importance of College boys continuing to grapple with important current issues through debate and conversation, much like many of the eminent Anglican Institution alumni had done over a century ago.

Safika Holdings

Media center

- In remembrance of Justin Pitt

- Justin Pitt Dies, Safika Loses One Of Its Own.

- Safika chair appointed non-executive director of global packaging and paper group Mondi

- Macozoma’s Ntsimbintle has vehicle for manganese consolidation following Gilbertson ouster

- New Mokala manganese mine heading for steady state, solar power

Contact us

+27 11 483 0840

info@safika.co.za

Safika House

First Floor

89 Central Street

Houghton

2198