Safika pays tribute to Nelson Mandela

In years to come it is entirely possible that the world will view Nelson Mandela as one of the greatest men who ever lived. He led the people of South Africa to freedom from tyranny and then, through the virtues of tolerance and forgiveness, won over his persecutors and created a society in which both white and black prosper.

Before Mandela, black people were not allowed to own companies, so without him our company would not even exist. In the world before Mandela it would have been inconceivable that black people could own and run a major investment house. Mandela made it possible.

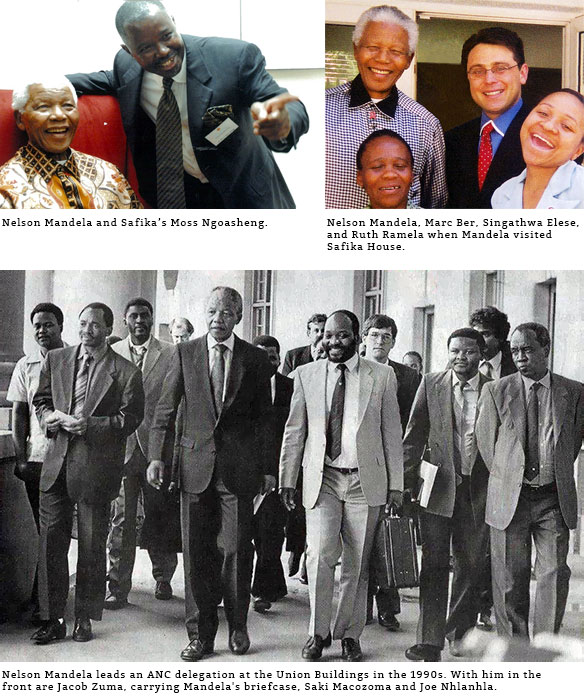

Three Safika directors and former shareholder, the late Soto Ndukwana, fought side-by-side with Mandela for freedom and were imprisoned with him on Robben Island; Moss Ngoasheng served seven years, Saki and Soto served five years and Richard served 11 years. Mandela mentored Saki and Moss during their imprisonment and both acknowledge the huge debt they owe him for his moral and political guidance. “It was Madiba’s personal intervention that led me to become an economist, which in turn led to me becoming Safika’s chief executive,” says Moss.

He recalls: “While I was in prison, I went to see Madiba to tell him that I wanted to study politics. He shook his head and said; ‘why don’t you study economics instead; in the future we are going to need men like you to be our economists’.” Then the great man handed Moss his personal Economics 101 notebook and told him to get started.

“That was it,” said Moss. “I became an economist and when democracy came I worked in the Presidency as chief economics advisor. Every time I would go into Madiba’s office he would laugh and remind me of his tattered old notebook. I would remind him how difficult it was to read his notes because he had terrible handwriting.”

Saki Macozoma recalls his first meeting with Madiba: “Meeting Nelson Mandela in November 1977 was like the epiphany on the road to Damascus for a young adult like me. I was young and angry. He was wise and caring. I had no idea that less than fifteen years later I would be writing speeches for a free Mandela and participating with him in the unfolding of a great historical moment, freedom for South Africa.

“When freedom came it was time to build South Africa. Safika Holdings was to become our modest but vital contribution to the reconstruction of the South African economy. At this sad moment we celebrate Madiba’s legacy through Safika’s contribution to the economy of South Africa. In Safika all South Africans have found a home in which they can use their talents to create wealth that all of us can share.”

Richard Chauke worked as a director of sport on Robben Island and recalls watching him play tennis. “He was pretty good,” he recalls. “I was not one of those close to Mandela on the island but like everyone else I placed my trust in him. He played an enormous role in my life because he was the glue that held us together and the values I hold today are the values I learned whilst on the island and those values came directly from Madiba.”

Madiba once visited Safika House; chief financial officer Marc Ber recalls that first a security team swept the building and then told everyone to stay in his or her offices when he arrived. “We did as were asked,” he said, “but when Madiba came walking in he stopped and said hello to everyone. In moments we were posing for pictures with him and being treated as if he had known us for years.”

We at Safika like to think that we honour Mandela by living as he would like us to do. We have built a flourishing business that we use to develop South Africa for the benefit of its people. We are investors in and responsible for multi-billion rand ventures that provide employment, bring tax revenues to the country and add to our country’s international reputation. Everything we do in business is possible only because Nelson Mandela and his comrades made it possible.

Safika owes another debt to Madiba; we learned our ethics on Robben Island taught to us directly by Mandela. He taught us not to dwell on the wrongs of the past but instead to focus on building the kind of society we would be happy to live in. Safika follows Madiba’s moral guidance; we will have no truck with corruption, we are honest in our dealings and we are always aware that our number one priority is help make South Africa economically stronger, in a way that benefits the people.

Thank you Madiba from all of us.

Saki Macozoma, Chairman

Moss Ngoasheng, Chief Executive